By Rebekah Rast

Nothing like a little tax question from the president to get you ready for April 17:

“When it comes to paying down the deficit and investing in our

future, should we ask middle class Americans to pay even more at a time

when their budgets are already stretched to the breaking point? Or,

should we ask some of the wealthiest Americans to pay their fair share?”

President Obama said in his weekly address.

Interesting how the only option is an either or. Tax one group or tax the other — take your pick.

Obviously, the president would like to tax the “rich,” using his

favorite model provided by billionaire investor Warren Buffett. Under

the Buffett rule everyone making more than $1 million will pay at least

30 percent of their income in taxes — whether it comes from income or

investment.

According to the Huffington Post,

Congress’ Joint Committee on Taxation estimated that if the Buffett

rule is enacted, it would only collect $47 billion through 2022 — a drop

in the bucket compared with the

$7 trillion in federal budget deficits projected during that period.

Where are the trillions of other dollars going to come from to pay down the deficit, Mr. President?

You see, even if Obama got everything he wanted, no strings attached,

it wouldn’t help bring down the deficit. Taking more from one group to

use on another is nothing but the redistribution of wealth. It does

not create new wealth and will not get America a balanced budget.

In fact, a likely scenario if the Buffett rule was enacted would be

to see the country go from bad to worse — further troubling the fiscal

crisis facing America.

The wealthy in this country usually invest their earnings. They

invest their wealth so it grows, but their investment also provides

capital for the growth of businesses, small and large alike. If

suddenly both investment and regular income are taxed at a much higher

rate, less money will become available for American businesses.

Even

The Christian Science Monitor explains that this rule sounds good in theory, but won’t work in practice:

“The Buffett rule sounds good in

principle. High-income taxpayers should pay at least as large a share of

their income in taxes as the rest of us. But most already do. On

average, middle-income households will pay 2015 taxes totaling about 15

percent of their income (using the legislation’s definition). Without

the Buffett rule, more than 99 percent of millionaires will pay more

than that and only about 4,000 will pay less. Barely 10 percent of them

will pay less than 20 percent. The proposed legislation would certainly

raise taxes on a lot of high-income taxpayers. But the price would be

even more complicated tax code.”

Even those media outlets that typically support the president can’t get all the way behind this plan. Nevertheless,

the plan is scheduled for a vote in the Senate on April 16.

Get full story

here.

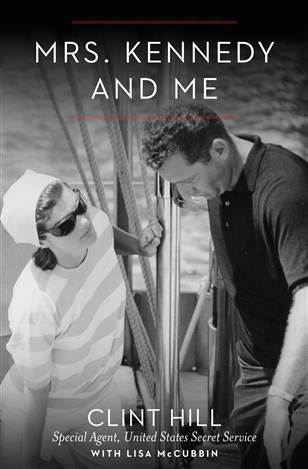

Ex-Secret Service agent Clint Hill has penned a book on his fond memories of protecting Jacqueline Kennedy.

Ex-Secret Service agent Clint Hill has penned a book on his fond memories of protecting Jacqueline Kennedy. By Rebekah Rast

By Rebekah Rast

Fox News

Fox News