I am no longer going to “let the perfect be the enemy of the good.” I am no longer going to try to talk people into seeing that the “right” thing to do with the Bush tax cuts would be to let them all expire. (The even “righter” thing would have been to never have enacted them in the first place.) I am just going to urge the policymakers to avoid doing something with the Bush tax cuts that seems totally contradictory to the fiscal policy goals–both shorter-term and longer-term–that they claim to have. In other words, let’s try to avoid doing something with the Bush tax cuts that seems totally crazy given what we say our fiscal policy goals are for both adequately supporting the (still fragile) short-term economy and better encouraging economic growth by reducing the deficit over the longer term.

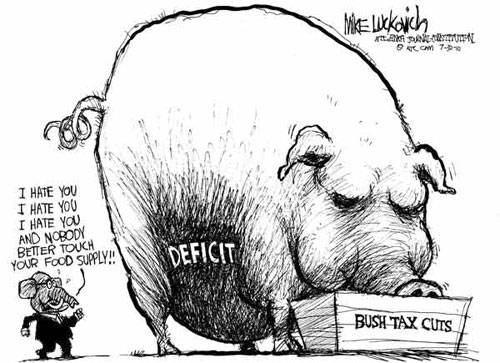

The fiscal policymaking in this town seems totally schizophrenic right now. What a juxtaposition to have President Obama’s deficit-reduction commission release its final report while the Administration “negotiates” with Congress on whether all of the Bush tax cuts, or just most of them, should be permanently extended (and deficit financed). The media has been reporting that whether the bulk of the Bush tax cuts will be extended or not is not the issue–it is whether the upper-bracket ones benefitting only the rich will be included as well, and what constitutes “rich.” (That floor may be moving up all the way to $1 million.)

Let’s remember that the permanent extension of “just” the “middle-class” Bush tax cuts, as President Obama has proposed, would add about $2.2 trillion to the debt over the next ten years–without interest costs and without the associated extension of Alternative Minimum Tax relief. Such extension would preserve the full value of Bush tax cuts for 97-98 percent of households while continuing to give the largest dollar value of tax cuts to those above the $250,000 threshold. (That’s because those in the upper tax brackets have income that passes entirely through the lower brackets.) Extending the upper bracket cuts along with the rest would raise the ten-year cost to close to $3 trillion (again, without interest). So the Administration and Congress are debating over whether we should commit to over $2 trillion, versus closer to $3 trillion, in deficit-financed Bush tax cuts.

Meanwhile, the President’s fiscal commission has recommended that federal revenues be increased as part of a package of policy changes that would get deficits down to economically sustainable levels by 2015 and beyond. Yes, it’s a package that is heavier on the spending-cut side than on the tax-increase side. Yes, it’s a tax proposal with a Republican-oriented goal of keeping marginal tax rates low, in fact, lower than Reagan-era tax rates. But the revenue increases come from broadening the tax base in ways that reduce tax preferences for higher-income households more than lower-income ones, preserving or even increasing the overall progressivity of the tax system while making the tax system more efficient. And the central message on tax policy from all of the various commissions, task forces, and study groups that have reported recently is pretty simple: beyond the next couple years, we need more revenue, not less.

That’s why I think it’s crazy to be arguing about which portions of the Bush tax cuts should be permanently extended. The first-best debate should be over whether to extend any of them at all, because whether it comes to our short-term tax policy needs (stimulate demand in the economy) or our longer-term tax policy needs (raise more adequate revenue in pro-growth ways), the Bush tax cuts are far from the best (even tax) policy to address those needs. Note that today the President’s own fiscal commission echoed the Bipartisan Policy Center’s call for a payroll tax holiday as a far more effective way to use tax cuts to stimulate the economy in the short-term. (See page 43 in the final commission report.) But if letting them all just go away is off the table, the second-best (but still “non-crazy”) debate should be whether we should be even considering letting the then-Bush-soon-to-be-Obama tax cuts go on for longer than the next couple years. And we should be talking seriously about whether we will continue to play the charade of “expiring tax cuts that never expire,” or if we can start making hard and better choices and honoring our other promises (like the one about reducing the deficit) that are contradictory to our bad habits on expiring tax cuts.

I think most Americans who are paying attention to today’s fiscal policy news are probably shaking their heads and/or cussing and/or laughing in a dark-humor sort of way. It seems both ridiculous and tragic that our leaders can proclaim their intent to get our fiscal house in order out of one side of their mouths, while arguing to keep (forever) their favorite piece of the fiscally-reckless and economically-ineffective Bush tax cuts out the other. They are so busy screaming at each other from their (sticky, embedded) corners that they can’t see the common ground between them.

So I make one open wish today, regardless of how politically-unrealistic I’m told this wish is: that policymakers could consider doing at least the “non-crazy” thing with the Bush tax cuts and stop proposing that any of them be permanently extended. Instead of frantically trying to “decouple” the high-end Bush tax cuts from the “middle-class” ones, we should be thinking about the best way to eventually “decouple” ourselves from all of them.

_______________________________

**UPDATE, 2:30 pm: note the latest news about an anticipated House vote on Thursday on the extension of the “middle-class” Bush tax cuts and Steny Hoyer’s somewhat “delirious” (crazed?) presentation of the issue to the press. I think he’s catching his own schizophrenia on the issue, when he says: “Why am I laughing?…And the answer to that is, I do not know.”

No comments:

Post a Comment